An estate plan is one of the most important plans you’ll make while alive. However, a lot of people ignore this plan for one reason or another. To ensure that you take this plan seriously, we have outlined some of its importance. But before we delve into that, let’s consider what estate planning is.

What is Estate Planning?

Though common, not everyone knows what the term estate planning is. And this is because a huge percentage of people don’t see the importance in planning an estate. Estate planning is simply a plan an individual makes while alive for the management, distribution, and or disposal of their assets during their lifetime of after their demise.

Types of assets that can comprise of an individual estate include real properties (like buildings and lands), intellectual properties, cars, insurance, shares and stocks, banks accounts, including other personal properties.

Importance of Estate Planning

1. It helps protect beneficiaries

If estate planning was regarded as one of those plan that only rich individuals make or need, that has changed. You see, today, several middle-class families’ need a plan in place should in case something happens to the breadwinner of the family. Moreover, you don’t have to be very rich to succeed in the stock market or real estate, both of which yield assets you’ll want to transfer to your heirs.

Even if you would be leaving behind a second car, if you don’t decide who gets the asset after your demise you won’t have any control over what happens to it. And that is simply because the primary goal of estate planning is choosing beneficiaries for your assets, regardless of what the asset is. Without an estate plan, the court will choose who gets your assets, a process which is time-consuming and frustrating.

2. An estate plan protects minors

No one imagines dying young. However, if you are the parent of a minor, it is important that you prepare for the unthinkable. This is where the will portion of an estate plan is introduced. To make sure that your children are well catered for, especially in a way that you approve, you’ll want to designate their guardians in the event that both parents die before the kids become adults. Without a will that consists of the names of a guardian or guardians, the court will step in to decide who will bring up the children.

3. An estate plan prevents family scuffle

Of course, I guess you are very familiar with the horror stories. Someone dies and the war between family members starts. One sibling may think that he deserves the house while the other, being the eldest, may object and from there a scuffle starts. Such disagreement get ugly and end up in court, with family members pitted against each other.

Stopping these fights before they start is another reason why estate planning is very essential. This plan will enable you to designate an individual who will control or manage your finances and assets if you become incapacitated or if you kick the bucket.

4. Protect loved ones from paying huge taxes

One of the primary aim of creating an estate plan is to protect loves ones, which also means providing them with protection from the Internal Revenue Service (IRS). Important to estate planning is transferring assets to beneficiaries while ensuring that they don’t pay much in taxes.

Even a little estate planning can help couples lessen much or even all of their federal and state estate taxes including state inheritance taxes. There also exist ways to lessens the income tax beneficiaries may have to remit. Without an estate plan, the amount of money owned by your beneficiaries to the IRS will be pretty much.

Need an estate planning attorney?

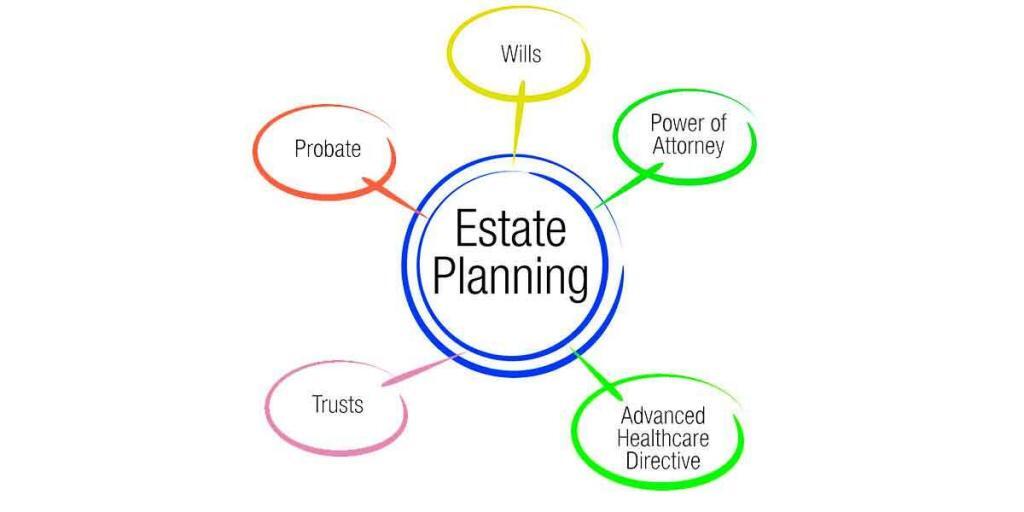

Planning an estate can be a complicated process. It involves a lot of paperwork and legal documents like power of attorney, trust, will, etc. Thus, if you want to plan your estate the right way, it is important that you contact a professional.

An estate planning attorney can help you in several ways. This professional can help you plan your estate and help you create the necessary estate planning documents. If you need to update your estate plan, this professional can be of help as well. Also, if you have concerns or questions, contacting an estate planning attorney is the best way to find answers.

We boast of competent estate planning attorneys who can help you navigate the tough estate planning process. Simple get in touch with our office so we can offer you or your loved ones our professional services.