It is great to have all your estate planning documents complete and current. But the work and expense doesn’t do much good if key people don’t know about the documents and have access to them. There can be consequences when key elements of the estate planning and other important information are not known immediately or accessible to your loved ones, especially if you fall ill or get covid 19. Medical and financial decisions and actions will be delayed or won’t be made by the people you wanted. To avoid these problems, when you get covid 19, it is essential to have the legal documents.

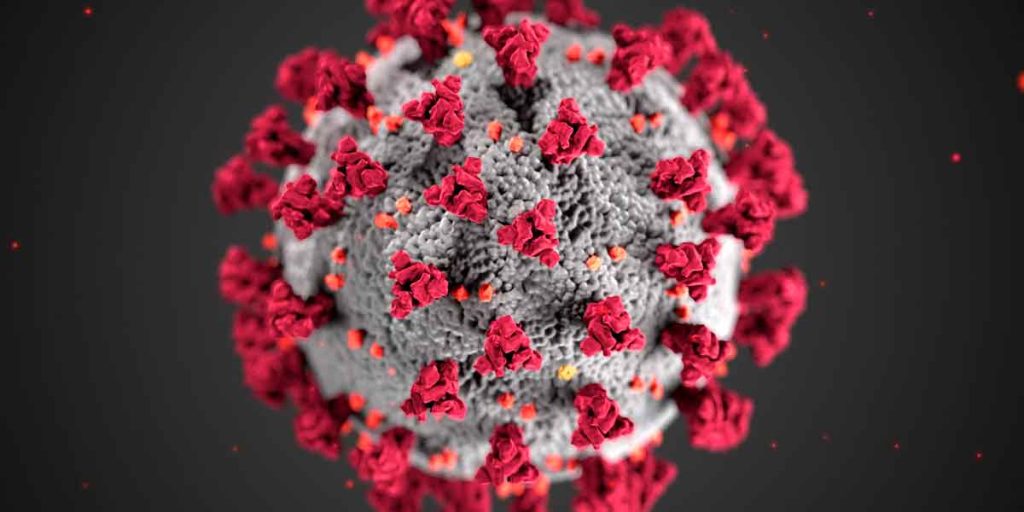

Meaning of covid 19

An outbreak of disease that occurs over a wide geographic area, as multiple countries or continent, and typically affects a significant proportion of the population.

The impact of the disease (covid 19) has affected humans in many ways, with quarantine and social distancing order, the pace of life has changed.

While this unprecedented time has been undeniably difficult, it has given many people a chance to spend more quality time with loved ones. It has also provided a space for thoughtfulness, reflection and reevaluation regarding what’s really important in life: family, health, happiness.

Documents to have when you get covid 19

An emergency like COVID-19 can make you think about things we typically cast aside for “another day.” Like estate planning. Fortunately, many estate planning attorneys are providing online services and advice. What are the documents to have in place to ensure your loved ones are supported if you get covid 19.

Will

A last will and testament lets you decide who gets your property upon your death. If you were to pass away without a will, your state’s laws would determine what happened to your property, which can lead to expensive litigation. This doesn’t just include the money you have in the bank, but also your family heirlooms and other special possessions. That’s why it is important for everyone, no matter their financial situation, to have a will. It is possible to create a will when you get covid 19.

Financial Power of Attorney

A financial power of attorney allows someone else to manage your finances when you cannot or when you get covid 19, If you are in the hospital and are unable to file your taxes or pay your bills, for example, a financial power of attorney would allow your agent to do those things for you.

Advanced Healthcare Directive

Depending on your state laws, an advanced healthcare directive might be called a medical power of attorney or a living will. This document allows you to say what kind of medical treatment you want, and who should make medical decisions for you, if you become very sick and unable to make those decisions yourself.

Guardianship

If you and your spouse were to pass away, do you have someone ready to take care of your children? A legally-binding guardianship document allows you to make that decision in writing so that the court doesn’t have to intervene and make this important decision for you.

Advanced Estate Planning Documents

With the volatile economic situation, you may want to consider wealth and tax planning. There are numerous trusts and options for transferring money that could be used depending on your unique situation. We recommend scheduling a phone or video consultation with an estate planning lawyer experienced in taxation and wealth planning to learn what is right for you.

A Health Insurance Portability and Accountability Account

Requires the protection and confidential handling of protected health information, release that permits another person, such as the named health care proxy and/or family members, to talk with medical providers about the client’s medical history and treatment.

Factors to consider in estate planning during or when you get covid 19

Is Your Existing Plan Up To Date?

If you already have an existing estate plan, you’re one step ahead of the game. Many things can change during the course of life, whether they be regarding your assets or beneficiaries, and your estate plan should reflect those changes.

Marriage, divorce, the purchase of a new home, the birth of a child or grandchild or a death in the family are just a few examples of life events that warrant updating your will or trust. It’s also a good idea to revisit your plan every three to five years.

Don’t let pandemic act as a deterrent that prevents you from prioritizing your end-of-life planning. These uncertain times should be a strong reminder that anything can happen no matter how secure things feel. Estate planning should be inclusive, accessible and affordable for all because everyone deserves peace of mind.

Is Your Will or Living Trust Up to Date?

The first step in estate planning is making sure that you have at minimum the following documents: a will, durable power of attorney, and patient advocate designation. For many, a living trust will be the centerpiece of their estate plan, allowing for an orderly management of assets during times of incapacity, the avoidance of probate, and the orderly distribution of assets at death.

Have You Been Procrastinating?

Procrastination is not only normal, it’s absolutely understandable. No one really wants to think about the end of their life. However, the alternative is that something happens to you before having a proper plan in place. That’s why it’s time to put your procrastination to a stop.

Creating a trust or will so you can nominate guardians for your children, decide how your assets should be distributed after your death and specify your final arrangement wishes can help you gain peace of mind and get back to enjoying life.

Get Help

If you would like to learn more about the necessity of estate planning as regards the covid 19, please contact any of our estate planning attorneys today.