Everyone needs estate planning. Whether young, old, wealthy, or with a modest estate, everyone needs a basic plan to give them assurance for the future should anything happen at any time.

And basic estate planning has to do with making plans for the management of your financial and personal affairs in the event you become incapacitated and the transfer of your assets when you eventually pass away.

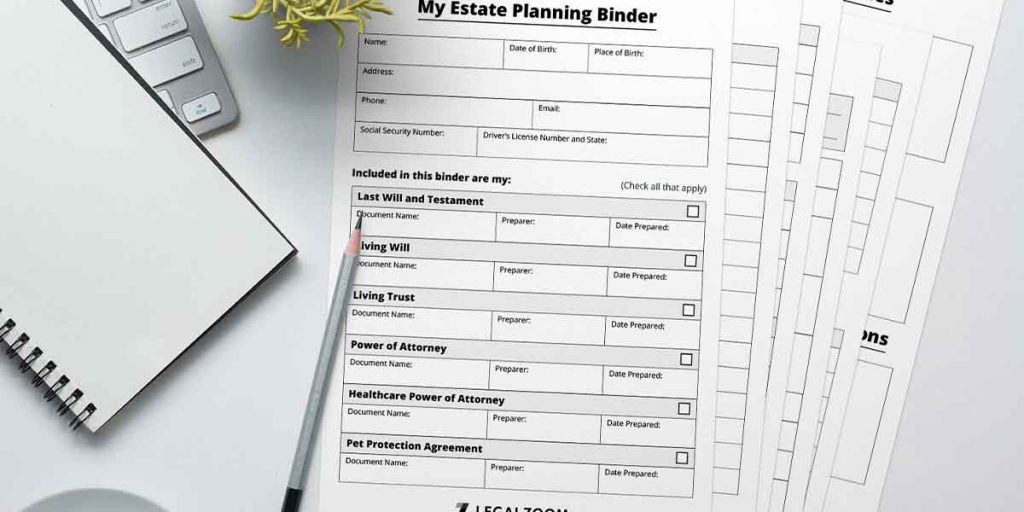

There are important documents that every estate plan should have. These documents are essential in that they help you achieve the fundamental goal of estate planning as described above.

To ensure you get your estate planning right and all your documents are properly established, get help from an estate planning lawyer near you.

Our estate planning attorneys are ready to assist you wherever you are in NY Buffalo.

Important documents to include in an estate plan

Will

A last will and testament, simply called a will, is a basic estate planning document on which you express your wishes concerning how you want your assets distributed when you pass away.

While you can download will templates online, it is important you use only a New York State will if you live in NYC. There are also several things to consider when drafting your will. It’s not all about allocating assets to beneficiaries. If you own property in multiple states, own a complex estate, are in a blended family, or look to avoid taxes, probate and possible complications, there are strategies an experienced estate attorney in NY 10016 will employ to help you achieve your goals.

And there are local legal requirements for writing a valid will. If you are not familiar with these laws, it’s best to consult an estate planning attorney near you.

Requirements for writing a will in NY Buffalo

- The will must be in writing.

- You (the testator) must be 18 years or above.

- You must be of a sound mind at the time of writing the will.

- There must be at least two witnesses concurrently present who must each sign and attest to the presence of each other.

- The will must also contain the written signature of the testator.

Living trust

Once you pass away, your will must be admitted into the probate court for validation. If the will is found to be valid, the probate process commences, where your executor will have to settle your debts, taxes, manage your investments, and distribute your assets. This process is typically complex, expensive, and lengthy in NY, taking months and even over a year before your inheritors can inherit, depending on the complexity of the estate.

But you can pass your assets in a living trust rather than a will. With a living trust, your assets pass to the beneficiaries directly and immediately without passing through probate. How is that possible?

A living trust is a legal agreement between the trust creator (grantor) and a trustee for the trustee to manage the trust assets on behalf of the beneficiary. The grantor funds assets into the living trusts by retitling the assets in the name of the trust. In that case, the trust becomes the owner. The grantor can name himself as the trustee and use the assets to his own benefit. He must, however, name a successor trustee who will manage the trust assets according to his laid out terms when he becomes incapacitated or deceased. At death, the assets go to the named beneficiaries outside probate.

A living trust is an important estate planning document because it helps you avoid the hassles of probate and can also be used for incapacity planning to an extent.

Power of attorney

A power of attorney (POA) is a document on which you name someone to manage your affairs on your behalf when you become unable to handle them yourself.

Durable financial power of attorney: With a durable financial POA, you appoint a trusted and competent agent to make financial decisions on your behalf. It is durable because it is still effective when you become incapacitated. It is an essential document for incapacity planning such that when you become incapacitated due to age or illness, there will be someone competent running things in your shoes. They are legally bound to always act in your best interests.

Healthcare power of attorney: This document, also known as the health care proxy, allows you appoint someone to make medical decisions on your behalf when you become incapacitated.

· Advance healthcare directive (Living will)

During an end of life situation, it could be that you wouldn’t want to be kept on life support for long when there’s almost no likelihood for survival. But you can’t make such decisions then. That’s why you have to make them now in your living will.

Get professional assistance from an estate planning attorney NY Buffalo

As there are legal requirements binding the validity of each document, it is essential you get expert legal help to avoid making costly mistakes.

Our estate planning lawyers NY are ready to assist you. Call us today.