Estate Planning Attorney near me 10027

Why You Need a Local 10027 Estate Planning Attorney Living in the 10027 zip code places you in one of New York City’s most vibrant

Home » Estate Tax Attorney

Why You Need a Local 10027 Estate Planning Attorney Living in the 10027 zip code places you in one of New York City’s most vibrant

Wills and Trusts on Long Island: A Comprehensive Guide to Protecting Your Legacy Life on Long Island, from the close-knit communities of Nassau County to

A Queens Resident’s Guide to Wills and Trusts From the historic homes of Forest Hills Gardens to the bustling multicultural streets of Flushing and the

Why Every Brooklyn Resident Needs a Valid Will Life in Brooklyn is vibrant, diverse, and full of unique opportunities. Whether you own a classic brownstone

Building a Successful Law Practice: Essential Insights from Russel Morgan The path to building a successful law practice is often shrouded in mystery, a journey

The Hidden Dangers of a Will-Only Estate Plan in NY For many New Yorkers, the term “estate planning” is synonymous with one document: the Last

Top Reasons to Hire an Estate Planning Lawyer In our digital age, the temptation to manage complex tasks ourselves is greater than ever. With a

Your Guide to Essential Estate Planning Documents in NY Embarking on the estate planning process can feel like navigating a dense forest of legal jargon

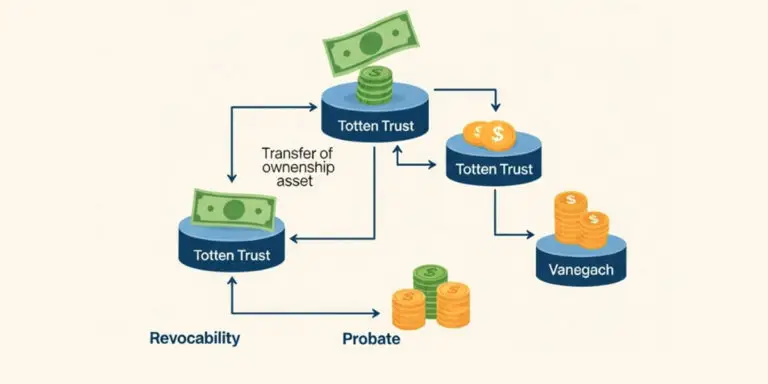

What Is a Totten Trust? An Expert Guide for New Yorkers In the world of estate planning, individuals often seek straightforward methods to transfer assets

6 Things to Know About Trump’s Potential Tax Policies & Estate Planning in New York: What You Should Know As we look ahead to potential

Celebrating Independence Day with a Commitment to Freedom and Financial Security: Estate Planning in New York As we celebrate Independence Day, July 4th, it’s a

Probate Lawyers in NYC: Navigating Estate Administration in 2025 The loss of a loved one is a difficult experience, often compounded by the complexities of

The Role of an Elder Law Attorney in New York: Protecting Seniors and Their Futures As individuals age, they often face unique legal and financial

Mastering Wills and Trusts: Crafting Your Ideal New York Estate Plan Creating a comprehensive estate plan is critical in protecting your assets, providing for your

7 Essential Things You Need to Know About Estate Planning in New York Estate planning can seem overwhelming, but it’s one of the most important

Navigating Wills and Trusts: Why You Need Experienced Lawyers in New York Creating a comprehensive estate plan is crucial in protecting your assets, providing for

Honoring the Legacy of Hard Work and Protecting Your Family’s Future: The Morgan Legal Group Story At Morgan Legal Group, we understand that estate planning

From Refugee to Legal Pioneer: Russel Morgan’s Journey of Resilience and Success – A Comprehensive FAQ At Morgan Legal Group P.C., we are so proud

Navigating Probate Litigation in New York: Expert Guidance from Morgan Legal Group Dealing with the loss of a loved one is challenging enough without the

Expert Estate Litigation in New York with Morgan Legal Group: Protecting Your Inheritance and Ensuring Justice is Served Estate litigation involves numerous challenges, particularly when

New York Guardianship Proceedings: Protecting Incapacitated Individuals with Expert Legal Guidance from Morgan Legal Group Guardianship proceedings are crucial in protecting the rights and assets

Will Contest Lawyer in New York: Challenging Invalid Wills and Protecting Your Inheritance Challenging the validity of a will can be a complex and emotional

All About Wills and Trusts: Understanding Your Options for Estate Planning in New York Welcome to Morgan Legal Group P.C., your trusted partner for expert

Seeking an Estate Planning and Probate Attorney in Brooklyn, New York: Expert Guidance for Securing Your Family’s Future Welcome to Morgan Legal Group P.C., your

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A

Expert Estate Litigation in New York with Morgan Legal Group: Protecting Your Inheritance and Resolving Family Disputes Estate litigation involves numerous challenges, particularly when you’re

All About Probate in New York: A Comprehensive Guide Welcome to Morgan Legal Group P.C., your trusted source of information and guidance on the intricate

Will Lawyer NYC in 2025: Your Guide to Secure Estate Planning Planning for the future is a responsibility we all share. In New York City,

Honoring Juneteenth: Reflecting on Freedom, Equality, and Empowering Generational Wealth Through Estate Planning in New York Juneteenth, also known as Freedom Day, commemorates the emancipation

Who is a Probate Lawyer in New York, and Why Do You Need One? When a loved one passes away, their estate must be managed

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC | Sitemap