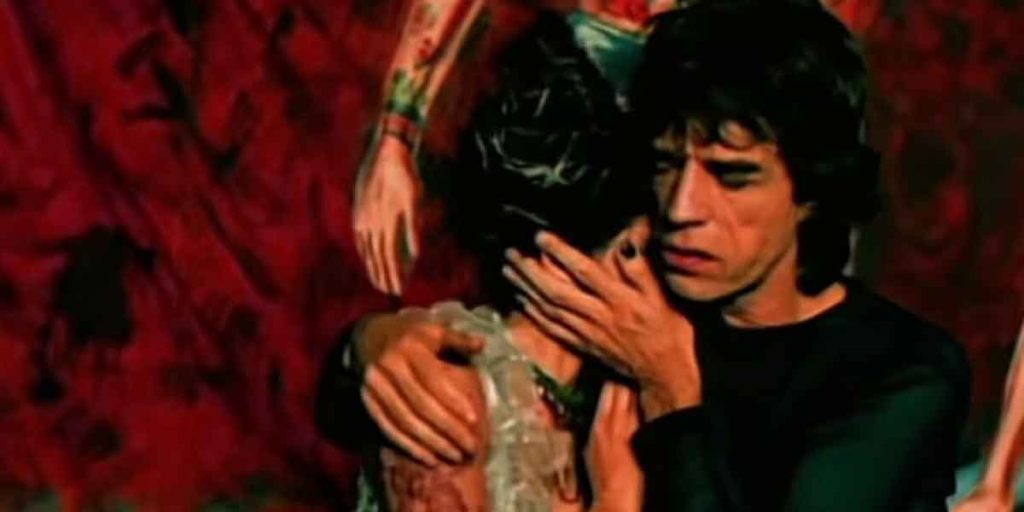

According to her Will, NY designer, L’Wren Scott left behind a good amount of money to Rolling Stones legend, Mick Jagger.

The Will For Mick Jagger

Mr Jagger has a fortune apparently more than $300 million. Ms. Scott was worth around $9 million. Just Mr. Jagger and Ms. Scott know the genuine condition of their relationship at the hour of her passing.

By deciding to move her estate exclusively through a Will, Scott made a trust that might have streamed to Mr. Jagger secretly, giving him assurance from legitimate examination and domain charges.

The basic way by which Ms. Scott excluded her kin leaves the Will open to challenge. Media reports note the lawyer didn’t observer Ms. Scott execute the Will. Finished in 2013, under a year prior to she ended it all, the psychological condition of the spouse could be lawfully addressed. She obviously expected to exclude her two receptive kin. Alienation to her sister is demonstrated when correspondence was wiped out throughout the previous six years.

In the event that expected beneficiaries of Scott challenge her Will, it is pronounced invalid. As an occupant of New York, her monetary largesse would almost certainly be isolated by state resolution between her sibling and sister, however nothing to Mr. Jagger.

In spite of her monetarily grieved business and supposed relationship challenges, Ms. Scott was clever. The explanations behind her self destruction and the thinking behind her Will stay muddled.

While setting up a Will, it’s ideal to thoroughly consider all possible situations to guarantee there are no Will challenges. Assuming, shockingly, there is a test to a Will, it’s ideal to be however clear as conceivable to guarantee your goals seem to be done to the furthest reaches conceivable.

With a wide range of guidance on bequest arranging or different stories, morganlegalny.com can give you all that data.

FAQ

- What do estate planning attorneys do?

Estate Planning Attorneys guide you to perfect your Will once you have it drafted. They’ll give you top legal security towards all your legal finances like 401K and retirement with a Trust fund which you can leave with your attorney or someone within the family. An estate planning attorney can also provide health care in the future when you need it. There will also be suggestions provided to make sure the probate process is within your value range. With all this legal help, you’re guaranteed a successful plan

2. How much does a will cost in NY?

A usual Will can cost you about $1200 but with an estate plan package, it’ll be around the same price range or even less with a good estate lawyer. Then that can be much cheaper up too $300 to $1000 depending on your situation.

3. Irrevocable Trust vs Living Trust, what’s the difference?

An irrevocable trust is a trust that you cannot modify. This is a Trust that is guaranteed of the choices you’ve written down across your estate plan. It’s also official that the person written down as your truster is your rational choice that can’t be changed. A Living Trust is a trust that you can make while you’re alive and still be able to manage your assets while having a back up representative in case something hazardous does happen.

4. What are probate fees?

After the probate process, the price varies depending on which city or state you’re from. There’s hourly wages from either $150 an hour to $200.

5. Can I make an estate plan alone?

You are allowed to make your own estate plan but this would have you leave any significant amount of errors if it isn’t viewed by an actual lawyer. So making your own estate plan might be an invalid one if not looked over.

6. What is probate lawyer?

A probate lawyer works with the decedent’s executor and beneficiaries listed on your Will to help those who need your finances. This can be avoided if you have a trust. A trust is a secure account under your name that legally requires you to hold all your money and a representative that has been written down ahead of time. Whoever it may be, it’s already been planned that this person would be managing your assets and estate.

7. How do you change irrevocable trust?

The only way for you to change a irrevocable trust is by contacting all the beneficiaries listed onto saying what needs to be modified with a good reason.

8. What is a Totten Trust Form?

This is a trust form that allows you to avoid probate due to already assigning a beneficiary after your name.