Estate Planning Attorney near me 10020

Why You Need a Local 10020 Estate Planning Attorney The 10020 zip code is not just a location; it is a global symbol of power,

Home » Estate planning attorney near me 10044

Why You Need a Local 10020 Estate Planning Attorney The 10020 zip code is not just a location; it is a global symbol of power,

Why You Need a Local 10016 Estate Planning Attorney The 10016 zip code is a dynamic and vital artery of Manhattan, pulsing with the energy

Why You Need a Local 10017 Estate Planning Attorney The 10017 zip code is the nerve center of global commerce and diplomacy. It is the

Why You Need a Local 10022 Estate Planning Attorney The 10022 zip code is a global synonym for influence, affluence, and ambition. It is the

Why You Need a Local 10012 Estate Planning Attorney The 10012 zip code is not just a location; it’s a living, breathing epicenter of art,

Why You Need a Local 10013 Estate Planning Attorney The 10013 zip code is a world-renowned capital of style, culture, and finance. It is a

How the Medicaid Look-Back Period Affects New York Estate Planning For generations of New Yorkers, the goal has been simple: work hard, buy a home,

Why You Need a Local 10030 Estate Planning Attorney The 10030 zip code is the cultural and historic epicenter of Central Harlem. From the architectural

Why You Need a Local 10037 Estate Planning Attorney The 10037 zip code is the heart of historic Harlem, a neighborhood rich with culture, community,

Why You Need a Local 10011 Estate Planning Attorney The 10011 zip code is more than just a place on a map; it’s a dynamic

Why You Need a Local 10018 Estate Planning Attorney The 10018 zip code is the engine room of Manhattan. Spanning the iconic Garment District, the

Why You Need a Local 10019 Estate Planning Attorney Life in the 10019 zip code is lived at the vibrant heart of the world. Encompassing

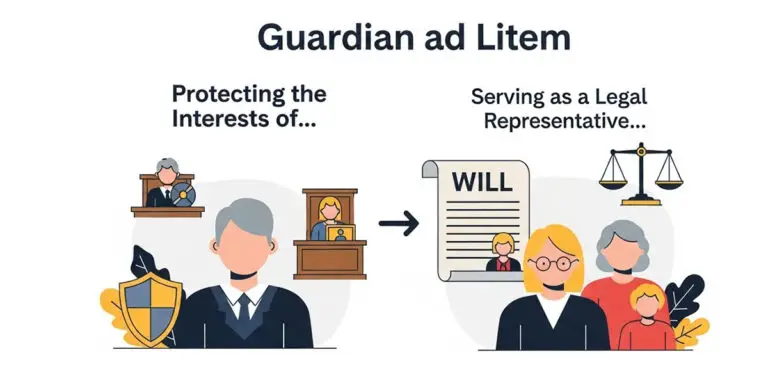

A Client’s Guide to the Guardian ad Litem in NY Estates The New York Surrogate’s Court system is designed to oversee the complex process of

Why You Need a Local 10027 Estate Planning Attorney Living in the 10027 zip code places you in one of New York City’s most vibrant

Wills and Trusts on Long Island: A Comprehensive Guide to Protecting Your Legacy Life on Long Island, from the close-knit communities of Nassau County to

A Queens Resident’s Guide to Wills and Trusts From the historic homes of Forest Hills Gardens to the bustling multicultural streets of Flushing and the

Why Every Brooklyn Resident Needs a Valid Will Life in Brooklyn is vibrant, diverse, and full of unique opportunities. Whether you own a classic brownstone

Building a Successful Law Practice: Essential Insights from Russel Morgan The path to building a successful law practice is often shrouded in mystery, a journey

The Hidden Dangers of a Will-Only Estate Plan in NY For many New Yorkers, the term “estate planning” is synonymous with one document: the Last

Top Reasons to Hire an Estate Planning Lawyer In our digital age, the temptation to manage complex tasks ourselves is greater than ever. With a

Your Guide to Essential Estate Planning Documents in NY Embarking on the estate planning process can feel like navigating a dense forest of legal jargon

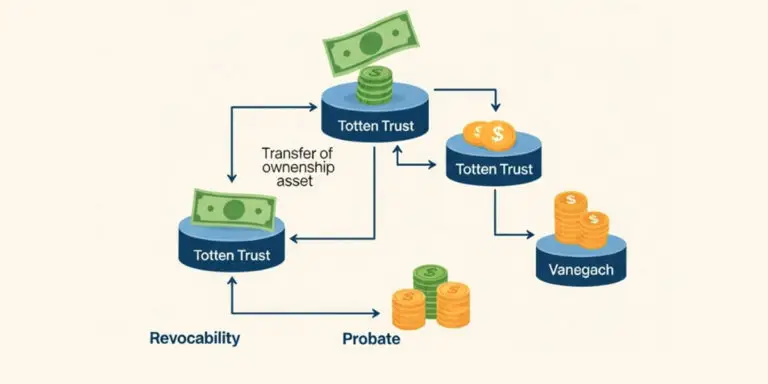

What Is a Totten Trust? An Expert Guide for New Yorkers In the world of estate planning, individuals often seek straightforward methods to transfer assets

6 Things to Know About Trump’s Potential Tax Policies & Estate Planning in New York: What You Should Know As we look ahead to potential

Celebrating Independence Day with a Commitment to Freedom and Financial Security: Estate Planning in New York As we celebrate Independence Day, July 4th, it’s a

Probate Lawyers in NYC: Navigating Estate Administration in 2025 The loss of a loved one is a difficult experience, often compounded by the complexities of

The Role of an Elder Law Attorney in New York: Protecting Seniors and Their Futures As individuals age, they often face unique legal and financial

Mastering Wills and Trusts: Crafting Your Ideal New York Estate Plan Creating a comprehensive estate plan is critical in protecting your assets, providing for your

7 Essential Things You Need to Know About Estate Planning in New York Estate planning can seem overwhelming, but it’s one of the most important

Navigating Wills and Trusts: Why You Need Experienced Lawyers in New York Creating a comprehensive estate plan is crucial in protecting your assets, providing for

Honoring the Legacy of Hard Work and Protecting Your Family’s Future: The Morgan Legal Group Story At Morgan Legal Group, we understand that estate planning

Ⓒ 2025 - All Rights Are Reserved | Privacy Policy | Estate Planning Attorney NYC