When a loved one passes away, the emotional toll is heavy. In the midst of grief, you are handed a legal title: “Executor.” Along with this title comes a stack of documents, a confusing Will, and the advice of well-meaning friends who say, “You don’t need a lawyer. Just go down to the court and fill out the forms.”

In many states, this might be true. In New York, it is a dangerous myth.

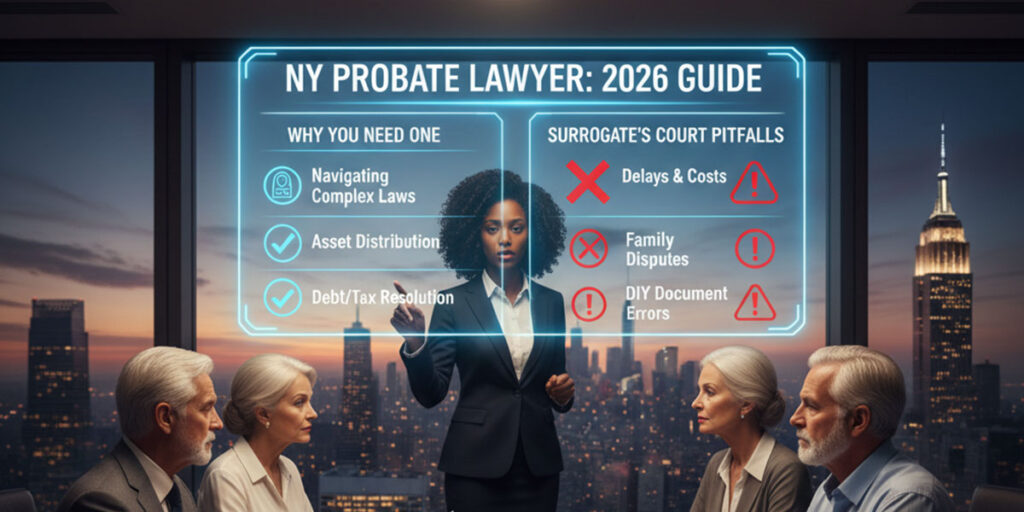

I am Russel Morgan, and at Morgan Legal Group, we have spent many years navigating the labyrinth of the New York Surrogate’s Court system. We have handled over 1,000 cases, from simple uncontested estates to vicious multi-million dollar battles. If there is one lesson I have learned, it is this: Probate in New York is not a clerical task; it is a lawsuit.

In 2026, the stakes are higher than ever. With the full transition to digital filing (NYSCEF), stricter judicial oversight, and the looming complexities of the 2026 Tax Sunset, attempting to navigate this system without counsel is not just difficult—it exposes you to personal financial liability.

This guide is not a sales pitch. It is a reality check. Below, I detail exactly why the probate process requires a professional, and the specific traps that await the “DIY” Executor in New York.

1. The “Simple Estate” Fallacy

The most common reason people attempt DIY probate is the belief that “Dad’s estate is simple.”

In New York law, there is no such thing as a truly “simple” estate if it involves real estate or assets over $50,000.

The Jurisdiction Trap

To start probate, you must obtain “jurisdiction” over every interested party. This doesn’t just mean the people named in the Will. You must identify, locate, and notify every person who would have inherited if the Will didn’t exist (the “distributees”).

The 2026 Reality: Families are fractured. People move. If you cannot find your second cousin in California, or if your estranged brother refuses to sign a “Waiver and Consent,” your DIY application hits a brick wall. A probate lawyer knows how to use “Supplemental Citations” and “Due Diligence Affidavits” to force the court to move forward, even when heirs are uncooperative.

2. The Bureaucracy of 2026: E-Filing and Procedural Rigor

The days of walking into the court clerk’s office with a paper petition are ending. In 2026, New York’s Surrogate Courts (especially in Queens, Kings, and New York Counties) are heavily reliant on the **NYSCEF (New York State Courts Electronic Filing)** system.

The “Rejection” Cycle

Court clerks in New York are trained to reject filings for minor errors.

- Did you use the wrong ink color? (Must be black).

- Did you remove the staples from the original Will to scan it? (Fatal error: The court will now presume the Will was tampered with, triggering a ” Staple Affidavit” requirement or a hearing).

- Did you fail to redact a Social Security number?

The Lawyer’s Role: We use professional legal software to generate the Petition for Probate, the Decree, and the Notices. We know the specific quirks of each county clerk—what gets rejected in Brooklyn might pass in Nassau. We handle the e-filing so you don’t have to battle the technology.

3. Executor Liability: You Are Personally on the Hook

This is the part most DIY Executors do not understand until it is too late. When you accept the role of Executor, you assume a Fiduciary Duty.

The Creditor Trap

You are responsible for paying the decedent’s debts in a strict statutory order (Funeral expenses > Taxes > Judgments > Credit Cards).

The Risk: If you pay the credit card bill because you want to “do the right thing,” but then you run out of money to pay the IRS or the funeral home, you are personally liable. The court can surcharge you, meaning you must pay the difference out of your own pocket.

The Tax Trap

As Executor, you are responsible for filing the decedent’s final income tax return and potentially an Estate Tax return. In 2026, with the federal exemption dropping, mistakes here are costly. If you distribute money to beneficiaries before the IRS is paid, the IRS will come after you.

4. Family Dynamics: When Grief Turns to Greed

Money changes people. We have seen close-knit families tear each other apart over a stamp collection or a bank account. A neutral third party is essential to manage these tensions.

The “Will Contest” Threat

If a relative feels slighted, they have the right to object to the Will. This triggers “SCPA 1404 Examinations,” where the witnesses to the Will and the attorney-draftsperson are deposed.

Why You Need a Lawyer: If you are the Executor, you cannot defend the Will alone. You need a litigator to protect the estate’s assets from frivolous claims. At Morgan Legal Group, we specialize in contested probate defense.

5. Real Estate: The Crown Jewel of Conflict

For most New Yorkers, the most valuable asset is the home. Selling a home that is stuck in probate is not like a regular real estate transaction.

The Title Issue

You cannot sign a deed or a listing agreement until you have “Letters Testamentary.” Real estate agents often don’t understand the nuances of “limited letters” or “restrictions on sale.”

The Lawyer’s Role: We coordinate with the title company to ensure the “Certificate of Appointment” is clean. We draft the Executor’s Deed. We handle the closing to ensure the proceeds go into a proper Estate Account, not your personal account (which is commingling and illegal).

6. The Complexity of Modern Assets (Crypto & Digital)

In 2026, estates are no longer just stocks and bonds. They include:

- Cryptocurrency wallets.

- NFTs.

- Revenue-generating social media accounts.

- Cloud-based business files.

Accessing these requires specific legal authority under New York EPTL Article 13-A. A standard DIY petition often lacks the specific language needed to force Apple, Google, or Coinbase to release these assets. We draft petitions specifically designed to unlock digital wealth.

7. The Cost of Mistakes (Penny Wise, Pound Foolish)

Clients often ask, “Can I save money by doing it myself?”

The Reality: DIY probate usually costs more in the long run.

- Delays: Every month the house sits empty because your paperwork was rejected, the estate loses money (taxes, insurance, maintenance).

- Lost Assets: Unclaimed funds often go unnoticed without a professional asset search.

- Legal Cleanup: We frequently charge more to fix a botched DIY probate than we would have charged to handle it correctly from the start, because we have to undo improper filings.

8. Morgan Legal Group: Your Shield and Your Guide

Why choose us? Because we don’t just fill out forms; we provide strategy.

Our approach is holistic:

- Immediate Action: We file for “Preliminary Letters Testamentary” to get you access to assets fast, while the full probate is pending.

- Asset Protection: We identify creditors and negotiate debts down, saving the estate money.

- Tax Efficiency: We work to minimize estate taxes and income taxes for the heirs.

- Conflict Resolution: We stand between you and the angry relatives, absorbing the stress so you can grieve.

Conclusion: Honor the Legacy by Doing It Right

The probate process is the final chapter of a person’s life. It deserves to be handled with dignity, precision, and professional care. The New York Surrogate’s Court is not a place for amateurs, especially in the complex legal environment of 2026.

Don’t risk your family’s inheritance or your own financial safety. Schedule a consultation with Morgan Legal Group today. We serve clients across all five boroughs and Long Island. Let us carry the legal burden so you can focus on your family.

To understand the specific duties you are undertaking, you can review the New York State Court Guide for Executors.