The Benefits and Drawbacks of Using a Corporate Trustee in New York

When establishing a trust in New York, one of the most important decisions you’ll make is choosing the right trustee. The trustee is responsible for managing the trust assets according to the trust document’s terms and in the beneficiaries’ best interests. While many people choose a family member or friend to serve as a trustee, another option is to use a corporate trustee. But what does this even mean? A corporate trustee is a financial institution, such as a bank or trust company, specializing in trust management. Weighing the pros and cons of each type of trustee is crucial for making an informed decision that aligns with your specific needs and goals, which is why our team can help! At Morgan Legal Group New York, we are ready to assist.

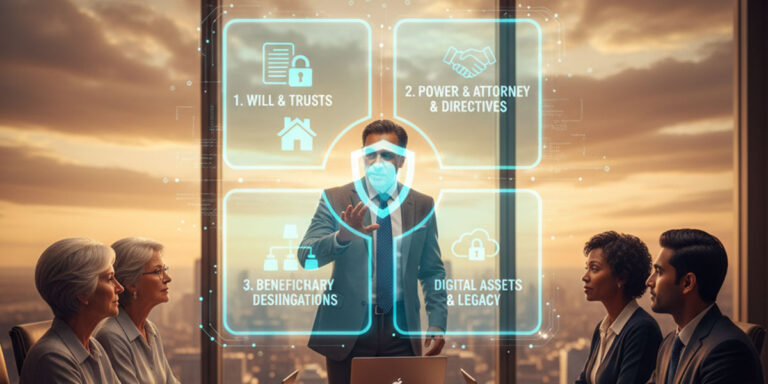

This comprehensive guide will explore the benefits and drawbacks of using a corporate trustee in New York, explaining the services they provide, the fees they charge, the potential advantages and disadvantages compared to individual trustees, and how to determine if a corporate trustee is right for you. The plan needs to meet your specific needs best. We will explore how we can best meet your needs. To ensure you make the best choice, we will discuss the following:

This all helps to get a better mindset and understanding of what it all means!

What is a Corporate Trustee?

A corporate trustee is a financial institution (such as a bank, trust company, or other financial services firm) that specializes in administering trusts and managing assets on behalf of beneficiaries. These organizations have considerable resources dedicated to these responsibilities! They are subject to regulation and audits, providing a level of oversight that an individual trustee may not have. The legal requirements are complex, and there are many codes to follow! Some may feel overwhelmed! But it doesn’t have to when you understand it and see what happens next! This will ensure that the process has all the steps that need to be met.

Corporate trustees offer a wide range of services, including:

These roles are in order to ensure your trust is sound! It is an essential goal that must be in place!

Benefits of Using a Corporate Trustee

Choosing a corporate trustee offers several potential benefits. Let’s review and unpack some of the most essential benefits. These tips can lead to a smoother future:

- Professional Expertise

- Impartiality

- Continuity

- Financial Security

- Objectivity!

These are all important traits that should be looked at! Now, let’s understand more in detail!

Professional Expertise

Corporate trustees have specialized knowledge and expertise in trust management, investment strategies, tax planning, and estate administration. Their experience is a great tool for support, and is more readily available for this process! To have this, you also have to ensure that they are skilled! The main aspects that must be there are:

- Certification of skills and expertise

- Openness and Transparency

- Proper Communication

When all of these come together, then there can be something special happen, it is more than just doing the job but rather helping you with care!

Impartiality

Unlike family members or friends, corporate trustees can act impartially and objectively in the best interests of all beneficiaries. This can be particularly important in situations where there are complex family dynamics or potential conflicts of interest. It is important that there is trust! The traits that are key when working include:

With this as the baseline, both are sure to succeed!

Continuity

Corporate trustees provide continuity of service, ensuring that the trust will be managed professionally and effectively for as long as it is in existence. It is important to know what goes into longevity and what makes it long-lasting! Longevity can have these benefits when considering a lawyer:

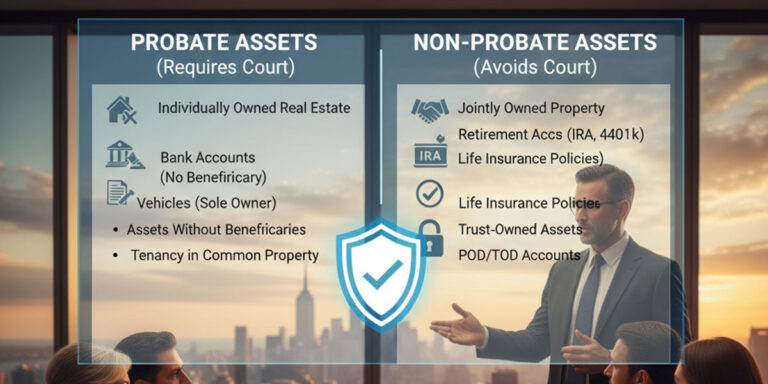

Financial Security

Corporate trustees are subject to strict regulations and audits, providing a level of financial security and accountability that an individual trustee may not have. We can all benefit from understanding the financials involved, right?

This includes:When all of this is met, we hope you can feel more at peace!

Drawbacks of Using a Corporate Trustee

Despite the many benefits of using a corporate trustee, there are also some potential drawbacks to consider. These should also weigh when you plan with them!

These all serve to ensure you have control.

What should we know about those mentioned above?

Higher Fees

Corporate trustees typically charge higher fees than individual trustees. These fees can include annual management fees, transaction fees, and other charges. It is always important to consider that the price is worth all that comes with the services. However, it may be difficult to navigate that portion. How do you know if you have a sound plan? Well it must involve an explanation of fees!

Communication Barriers

Communicating with a corporate trustee can sometimes be more difficult than communicating with an individual trustee. Corporate trustees may have multiple layers of bureaucracy, making it harder to get timely responses to your questions or concerns. But knowing what you are paying can help! What are you paying for? Are you getting regular check ins? What happens to your assets when questions arise? Having this level of check in can have you better prepare what is next!

Lack of Personal Touch

Corporate trustees may not provide the same level of personal attention and care that an individual trustee can. They may not be as familiar with your family dynamics or your specific wishes. You want someone to treat your situation with care! How can you do that? Let’s explore! To understand how to best work with this, these facts may be valuable: Is there a high turn around of the agents that you work with? Do they truly care about your plan! Are there constant changes with your needs? By knowing these, you can see where the true path leads and will also help you protect what you most want.

Determining if a Corporate Trustee is Right for You

Deciding whether to use a corporate trustee is a personal decision that depends on your individual circumstances, goals, and preferences. Consider the level of involvement, but to know the needs it is wise to learn: What are those goals you are attempting to reach! It is okay to go one way and shift the plan down the road! With that, let’s keep these points all in consideration!

A corporate trustee may be a good option if you:

- Have a large and complex estate

- Anticipate potential family conflicts

- Want professional expertise and financial security

- Don’t have anyone you can consider close.

To see if this path fits what you seek, consider working with these groups throughout NYC! - The beauty of what New York can offer!

- Our warm folks from Long Island

- The experts in NYC