In the complex world of estate planning, even the most meticulously crafted plans can unravel without proper attention to detail and ongoing review. The high-profile case of author Tom Clancy serves as a stark reminder of how ambiguities in a will or trust can lead to painful, public, and protracted family disputes. For residents of New York, understanding these pitfalls and taking proactive steps is paramount to protecting your legacy and ensuring your final wishes are honored.

The Tom Clancy Estate Dispute: A Cautionary Tale

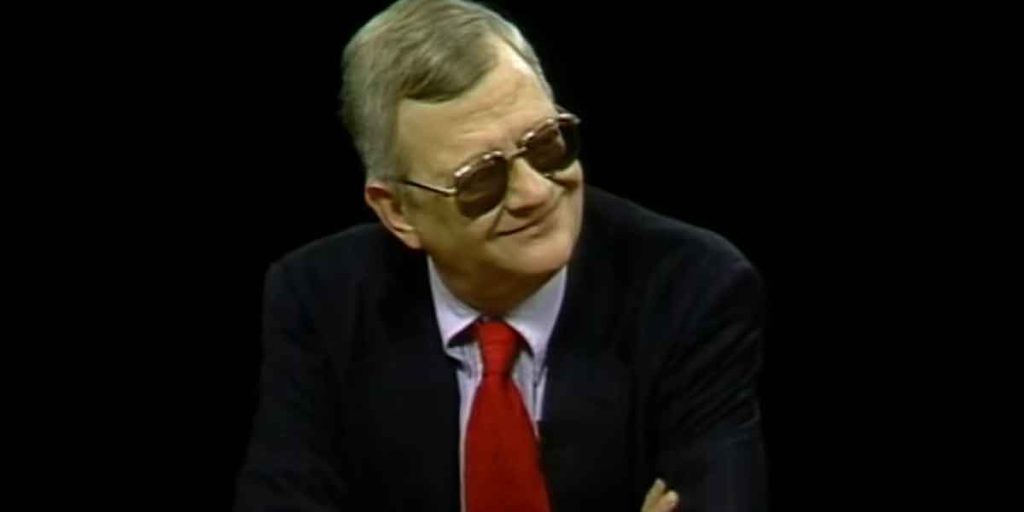

Tom Clancy, the renowned author known for his blockbuster novels, amassed a substantial estate valued at over $83 million. Following his passing, however, his carefully constructed estate plan became the subject of a contentious legal battle, illustrating the critical importance of clarity in testamentary documents.

- The Core of the Conflict: A key amendment to one of Clancy’s estate planning documents, reportedly his will, stipulated that no estate taxes were to be paid from trusts benefiting his wife. However, ambiguity arose regarding whether taxes should be paid from a separate trust intended for his entire family.

- Attorney’s Role Questioned: The attorney who drafted Clancy’s financial documents, including the disputed amendment, was also serving as the executor of his estate. This dual role, coupled with the attorney’s interpretation of the documents, was challenged by Clancy’s widow, who argued against his reading.

- Family Fallout: The lack of precise language and potential inconsistencies between various estate planning documents led to a significant disagreement among his heirs, transforming what should have been a clear distribution of assets into a prolonged legal contest.

Clancy’s case underscores a crucial lesson for anyone undergoing estate planning, particularly in New York: even with considerable wealth and professional assistance, if documents are not perfectly aligned and unambiguous, they can inadvertently sow the seeds of future conflict among beneficiaries.

Common Causes of Estate Plan Disputes in New York

The issues seen in the Clancy estate are not isolated incidents. Ambiguities and legal challenges are unfortunately common, especially in situations involving blended families or significant assets. Here are common reasons why estate plans in New York may lead to disputes:

- Ambiguous or Conflicting Language: Vague wording in wills, trusts, or other documents can lead to different interpretations among beneficiaries, executors, and the courts.

- Outdated Documents: Estate plans that are not regularly reviewed and updated can become irrelevant due to life changes (marriage, divorce, births, deaths, new assets) or changes in New York state law.

- Lack of Coordination: Modifying one document (like a will) without making corresponding amendments to others (like trust documents or beneficiary designations on financial accounts) creates inconsistencies that can be legally problematic.

- Blended Families: These family structures often introduce additional layers of complexity, requiring especially clear and comprehensive planning to ensure all parties feel equitably treated and expectations are managed.

- Improper Execution: Wills or other documents that are not signed, witnessed, or notarized according to New York’s specific legal requirements can be deemed invalid.

Preventing Estate Plan Disputes: Proactive Steps in New York

To safeguard your legacy and spare your loved ones from potential conflict, proactive and thorough estate planning is essential. Working with a qualified New York estate planning attorney is the most effective way to prevent future disputes.

- Engage a Skilled Attorney: Do not attempt to draft complex estate planning documents yourself. A knowledgeable attorney specializes in New York estate law and can anticipate potential issues, ensuring your documents are legally sound and clearly reflect your intentions.

- Regular Review and Revision: Your estate plan is not a one-time affair. It should be reviewed with your attorney at least every 3-5 years, or sooner if significant life events occur. This ensures all documents remain current and consistent.

- Comprehensive Planning: Beyond a will, consider trusts, powers of attorney, health care proxies, and other instruments that work together to form a robust and unambiguous plan.

- Clear Communication: While not a legal requirement, discussing your wishes with key family members can help manage expectations and reduce surprises after your passing.

For expert guidance on navigating the complexities of estate planning in New York and ensuring your legacy is protected, consider consulting with a reputable legal firm. morganlegalny.com offers comprehensive estate planning services designed to provide clarity and peace of mind.

Frequently Asked Questions About New York Estate Planning

Costs and Process

- How much does a Will cost in New York?

The cost of a Will in New York can vary significantly depending on its complexity and the attorney you choose. A basic Will might cost less, but a comprehensive estate plan package, which typically includes other essential documents like powers of attorney and health care directives, can range from $1,200 to several thousand dollars. While it’s an investment, the cost of an improperly drafted or contested Will can be far greater. For specific pricing and a personalized consultation, contact morganlegalny.com. - Can I create my own estate plan documents?

While you are legally permitted to draft your own Will or other estate planning documents in New York, it is strongly advised against. Self-drafted documents often contain errors, omissions, or ambiguities that can render them invalid or lead to significant disputes and unintended consequences for your beneficiaries. A qualified attorney ensures your documents comply with New York law and accurately reflect your wishes. - Do you need a lawyer for Advance Directives?

Advance Directives, such as Health Care Proxies and Living Wills, can be created by individuals over 18 without an attorney. However, similar to Wills, having an attorney prepare or review these documents is highly recommended. Legal guidance ensures they are correctly worded, legally enforceable in New York, and accurately reflect your specific healthcare wishes, preventing future challenges or misunderstandings.

Asset Protection and Debt

- Does a Trust protect assets from nursing home costs?

Certain types of irrevocable trusts, often used in conjunction with Medicaid planning, can protect assets from being counted towards Medicaid eligibility for long-term care, including nursing home costs. This is a complex area with strict look-back periods and specific legal requirements in New York. Proper planning well in advance is critical, and it absolutely requires the guidance of an elder law attorney. - What happens to debt when someone dies in New York?

When a person dies in New York, their debts do not simply disappear. Instead, their estate is responsible for paying off their outstanding debts before assets are distributed to beneficiaries. If the estate’s assets are insufficient to cover all debts, creditors may pursue the estate for payment. Beneficiaries are generally not personally responsible for the deceased’s debts unless they co-signed loans or held joint accounts. Proper estate planning can help structure assets to minimize the impact of debt on heirs.

Types of Trusts and Planning Tools

- What is a Totten Trust?

A Totten Trust, also known as a “payable-on-death” account, is a simple type of revocable trust created by depositing money into a bank account in your name as trustee for a named beneficiary. Upon your death, the funds automatically transfer to the beneficiary, avoiding probate. It’s a convenient tool for small accounts but doesn’t offer the comprehensive benefits or asset protection of a formal trust. - Does a Trust override a Will?

Generally, assets held within a properly funded trust are distributed according to the trust’s terms and typically avoid probate, independent of the Will. A Will primarily governs assets that are part of your probate estate and not held in a trust or by joint tenancy with rights of survivorship. While they have different functions, a well-drafted estate plan ensures that your Will and Trust documents work harmoniously to achieve your overall goals.

Specialized Legal Support

- What does an Elder Care Attorney do?

An Elder Care Attorney (or Elder Law Attorney) specializes in legal issues affecting older adults and individuals with disabilities. Their expertise extends beyond traditional estate planning to include Medicaid planning, long-term care planning, guardianship, powers of attorney, protection against elder abuse, and veterans’ benefits. They help clients and their families navigate the complex legal and financial challenges associated with aging. - Where can I find official New York legal information?

For general information on New York state legal resources, government services, and official legislative updates, visitors can consult the ny.gov website. However, for personalized legal advice pertaining to your specific estate planning or elder law needs, always consult with a qualified attorney. Official government websites provide general information and forms but cannot offer tailored legal counsel.