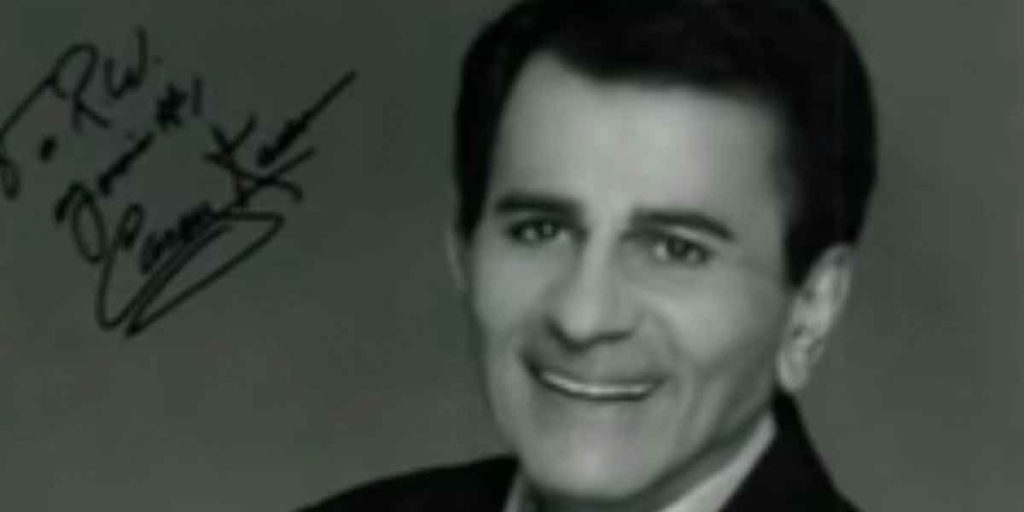

In the intricate landscape of personal finance and enduring familial legacy, few undertakings are as fundamentally crucial, yet frequently postponed, as the meticulous crafting of a comprehensive estate plan. The repercussions of neglecting this vital preparation extend far beyond mere administrative inconvenience, often escalating into prolonged legal entanglements and irreparable damage to family relationships. The widely chronicled dispute surrounding the estate of the beloved radio icon, Casey Kasem, serves as a sobering testament to these potential pitfalls, powerfully illustrating that even substantial wealth offers no immunity from conflict when a clear, legally sound New York estate planning strategy is conspicuously absent.

The Critical Imperative of Robust New York Estate Planning: Lessons from High-Profile Disputes

The tragic saga following Casey Kasem’s passing illuminated the profound drama and bitter contention that can erupt in the absence of definitive estate planning. Kasem, whose voice resonated with millions, bequeathed not only a considerable fortune but also a deeply divisive battle between his wife, Jean, and his three children from a prior marriage. This highly public struggle encompassed every aspect of his final years, from his medical care to the ultimate disposition of his remains. News reports vividly detailed the necessity of court intervention, culminating in an adjudicator granting his daughter, Kerri, a controlling order to prevent his wife from removing or cremating his remains before a thorough examination could be conducted.

This contentious situation unequivocally underscores why comprehensive New York estate planning is not merely a legal formality, but a profound act of foresight and care for your loved ones. At Morgan Legal, our steadfast mission is to empower families like yours to navigate the future with unwavering confidence, meticulously safeguarding your assets and preserving familial harmony, thereby ensuring your deeply held wishes are honored without the specter of costly court disputes and associated emotional turmoil.

Core Pillars of Modern New York Estate Planning

A truly robust estate plan constitutes a multi-faceted legal strategy meticulously engineered to protect your legacy, provide for your designated beneficiaries, and mitigate potential legal complications. For residents navigating the nuanced legal environment of New York, a thorough understanding of the available instruments and their strategic application is paramount.

Revocable Living Trusts: Unparalleled Flexibility and Probate Avoidance

A Revocable Living Trust stands as a cornerstone of contemporary estate planning, offering unparalleled flexibility and significant advantages over reliance on a traditional will alone. When you establish such a trust, you effectively transfer legal ownership of your assets (which may include real estate, bank accounts, and investment portfolios) from your individual name into the trust’s legal entity. Crucially, you typically serve as both the trustee and the primary beneficiary during your lifetime, thereby retaining complete control and the absolute ability to modify, amend, or even revoke the trust entirely.

- Probate Avoidance: Upon your passing, assets properly titled and held within a fully funded revocable trust bypass the often protracted, publicly accessible, and expensive probate process. This strategic maneuver ensures that your beneficiaries can receive their inheritances with significantly greater speed and privacy.

- Unmatched Flexibility: As long as you maintain legal capacity, you retain the power to make extensive changes to your trust, including adding or removing assets, modifying beneficiary designations, or altering distribution terms to reflect evolving circumstances.

- Enhanced Protection Against Challenges: Trusts are generally more difficult to contest in court compared to wills, offering an additional layer of security and assurance that your ultimate wishes will be upheld.

- Incapacity Planning: A well-drafted revocable trust designates a successor trustee who can seamlessly step in to manage your financial affairs should you become incapacitated, thereby avoiding the necessity of a potentially intrusive and costly court-appointed conservatorship.

Irrevocable Trusts: Advanced Strategies for Asset Protection and Tax Efficiency

In stark contrast to a revocable trust, an Irrevocable Trust, once established and funded, cannot be modified, amended, or revoked by the grantor. This definitive and permanent nature, while seemingly restrictive, confers potent advantages for achieving highly specific estate planning objectives, particularly in the realms of advanced asset protection and sophisticated tax planning.

- Key Differentiating Factors: With an irrevocable trust, you permanently relinquish legal ownership and control over the assets transferred into it. The trust thereupon becomes its own distinct legal entity, and its terms are fixed and unalterable.

- Optimal Application Scenarios: Irrevocable trusts are frequently employed for strategic purposes such as:

- Estate Tax Minimization: Effectively removing assets from your taxable estate, thereby reducing potential federal and New York state estate tax liabilities.

- Medicaid Planning: Protecting assets from being counted for Medicaid eligibility purposes, subject to specific look-back periods and legal requirements.

- Creditor Protection: Shielding assets from potential future creditors, lawsuits, or unforeseen financial judgments.

- Charitable Giving: Facilitating structured and tax-advantaged charitable contributions and philanthropic endeavors.

Last Will and Testament: The Foundational Document for Your Legacy

While various trust instruments offer significant advantages and strategic benefits, a meticulously prepared Last Will and Testament remains an absolutely fundamental component of virtually every comprehensive estate plan, particularly for those undertaking New York estate planning.

- Beyond Mere Asset Distribution: A will serves as your legal directive for how your individually owned assets (those not held in a trust, jointly owned, or with a specific beneficiary designation) will be distributed upon your passing. Crucially, it also empowers you to nominate guardians for your minor children, a profoundly important provision often regrettably overlooked.

- The Indispensable Role of an Executor: Your will explicitly names an executor, the designated individual entrusted with the fiduciary responsibility of overseeing the probate process, diligently paying outstanding debts and taxes, and distributing assets precisely according to your articulated instructions.

Life Insurance: A Strategic Tool for Financial Security and Equity

Life insurance policies serve as an exceptionally powerful and versatile vehicle for providing immediate liquidity and establishing specific financial provisions for designated beneficiaries. It can be particularly effective in navigating the complexities inherent in diverse family structures, such as blended families, ensuring equitable treatment and financial stability for all.

- Balancing Diverse Needs: A carefully structured life insurance policy can strategically provide for a surviving spouse, while simultaneously allowing other significant estate assets to be bequeathed to children from a previous marriage, or vice versa. The proceeds from life insurance are typically paid directly to the named beneficiaries, thereby strategically bypassing the potentially lengthy and public probate process.

Navigating Probate in New York State: Processes, Costs, and Avoidance Strategies

Probate constitutes the formal legal process through which a deceased person’s will is authenticated and validated by the court, their assets are systematically gathered and inventoried, outstanding debts and taxes are settled, and the remaining property is ultimately distributed to the rightful heirs or beneficiaries. In New York, this legal process can often prove to be both lengthy and inherently complex.

Deciphering the New York Probate Process

When an individual passes away with a valid will, the named executor presents it to the New York Surrogate’s Court to formally commence the probate proceedings. Conversely, in the absence of a will, the estate enters a process known as administration, wherein assets are distributed strictly in accordance with New York’s intestacy laws, which dictate inheritance patterns by statute.

Understanding Probate Costs and Timelines in NY

The probate process invariably incurs various costs, including but not limited to court filing fees, statutory executor commissions, professional appraisal fees, and attorney fees. In New York, attorney fees for probate can fluctuate significantly, often being calculated based on hourly rates (typically ranging from $150-$200+ per hour for experienced counsel) or, in some complex cases, as a percentage of the overall estate value. The total timeline for completing probate can vary dramatically, spanning from several months for straightforward estates to several years for highly complex estates, those involving disputes, or those facing heavy court caseloads.

Proactive Strategies for Efficient Probate Avoidance

Many individuals proactively seek to avoid probate due to its inherent costs, the significant time commitment involved, and its public nature. Key strategies employed to achieve probate avoidance include:

- Revocable Living Trusts: As previously discussed, assets meticulously titled and held within a revocable trust are designed to bypass the probate process entirely.

- Beneficiary Designations: Assets such as life insurance policies, retirement accounts (e.g., 401(k)s, IRAs), and designated “payable-on-death” (POD) or “transfer-on-death” (TOD) accounts are engineered to pass directly to the named beneficiaries, outside the purview of probate.

- Totten Trusts: Also colloquially known as “in trust for” accounts, these are bank accounts where you designate a beneficiary who will receive the funds directly upon your death, effectively bypassing the probate court.

- Joint Ownership with Rights of Survivorship: Assets held in joint tenancy with rights of survivorship (e.g., real estate, bank accounts) are automatically transferred to the surviving owner upon the death of one joint tenant, thereby avoiding probate for that specific asset.

The Essential Role of a Probate Attorney

A seasoned probate attorney provides invaluable assistance to the executor in meticulously navigating the intricacies of the Surrogate’s Court process. They ensure that all pertinent legal requirements are scrupulously met, that all debts and taxes are properly identified and settled, and that assets are distributed precisely in accordance with the provisions of the will or, in its absence, New York’s statutory intestacy laws. While the strategic implementation of trusts can significantly reduce or eliminate the need for a probate attorney in many instances, estates of greater complexity will almost invariably benefit from expert legal guidance throughout the administration process.

The Indispensable Value of an Experienced NYC Estate Planning Attorney

While various online resources and readily available templates exist for rudimentary estate planning, the inherent complexity of New York State law, coupled with the unique dynamics and specific goals of each individual family, renders professional legal guidance absolutely invaluable. An experienced New York estate planning attorney serves as your trusted, objective advisor throughout this profoundly critical journey.

Bespoke Guidance and Comprehensive Document Crafting

An estate planning attorney’s role extends far beyond the mere drafting of legal documents. They provide tailored legal security for the entirety of your financial assets, encompassing 401(k)s, retirement accounts, real estate holdings, and all other valuable possessions. They meticulously assess your unique personal circumstances, articulated goals, and intricate family dynamics to recommend the most efficacious strategies and precise legal instruments. This comprehensive approach includes perfecting your Last Will and Testament, establishing appropriate and specialized Trusts, and expertly advising on optimal beneficiary designations for all relevant accounts and assets.

Facilitating Harmonious Family Discussions

One of the most emotionally charged and challenging facets of estate planning can be initiating and sustaining sensitive financial discussions with family members. An attorney can skillfully facilitate these crucial family meetings, acting as a neutral, professional intermediary to help clearly communicate beneficiary statuses, asset distribution plans, and future provisions for the estate. This proactive and professionally mediated approach can dramatically mitigate the potential for future conflict and misunderstandings, a lesson starkly highlighted by the unfortunate Kasem family dispute.

Safeguarding Your Incapacity and Healthcare Wishes

Beyond the distribution of assets, comprehensive estate planning encompasses vital provisions for your health and financial well-being during your lifetime. Attorneys are instrumental in helping you establish legally binding powers of attorney, healthcare proxies, and living wills, thereby ensuring that your explicit wishes regarding medical treatment, end-of-life care, and financial management are honored with unwavering fidelity should you ever become incapacitated and unable to communicate your decisions.

The Perils of Self-Service Estate Planning

While it is technically possible for individuals to attempt to draft their own estate plan, this do-it-yourself approach is fraught with substantial and often unforeseen risks. Without a profound and current understanding of New York’s complex legal landscape and statutory requirements, common pitfalls inevitably include:

- Legal Invalidity: Documents may fail to meet highly specific legal formalities and execution requirements, rendering them completely unenforceable by the courts.

- Ambiguous Language: Vague, imprecise, or contradictory language within documents can lead directly to misinterpretation, confusion, and protracted disputes among your beneficiaries.

- Unforeseen Tax Consequences: Improper or incomplete planning can inadvertently result in avoidable estate taxes, gift taxes, or other significant financial penalties that could have been mitigated with expert advice.

- Incomplete Coverage: Critical aspects such as comprehensive incapacity planning, appropriate guardianship nominations, or specialized trust provisions might be overlooked entirely, leaving significant gaps in your protective strategy.

An estate plan that has not been meticulously reviewed, drafted, and executed by a qualified and experienced attorney could ultimately prove to be invalid, incomplete, or fundamentally flawed, costing your loved ones far more in legal fees, emotional distress, and lost inheritance than the initial, prudent investment in professional legal guidance.

Secure Your Legacy: Act Proactively with Expert New York Estate Planning

The profound lessons gleaned from high-profile estate battles, coupled with the inherent complexities and specific requirements of New York estate planning, collectively underscore a critical and undeniable truth: procrastination in this vital area is an exceptionally costly choice. Protecting your family’s future, diligently preserving your accumulated wealth, and ensuring that your final wishes are honored with absolute precision demands proactive, expert legal guidance. Today is, without question, the optimal time to establish, or comprehensively update, your estate plan for the most robust protection and profound peace of mind.

For any questions pertaining to sophisticated and robust estate planning strategies, or to commence the crucial process of securing your financial freedom and familial harmony, we urge you to connect with the experienced and dedicated team at morganlegalny.com or call us directly at (212) 561 – 4299. Allow us the privilege of helping you meticulously craft a legacy that truly and enduringly reflects your deepest intentions and cherished values.