Navigating Probate in New York: Your 2025 Roadmap

When a person passes away, their assets don’t magically transfer to their loved ones. Instead, their estate—everything they owned—enters a formal legal process to ensure their property is distributed correctly. In New York, this court-supervised process is known as probate. For many, the word “probate” conjures images of endless delays, overwhelming paperwork, and family disputes. While it can be complex, understanding the process is the first step toward navigating it effectively.

As we look ahead to 2025, the fundamentals of New York probate remain, but the context in which it operates continues to evolve with digital assets, updated tax laws, and changing family structures. As an attorney with over 30 years of experience guiding families through the New York Surrogate’s Court, I’ve seen how a lack of knowledge can turn a manageable process into a nightmare. This comprehensive guide from the experts at Morgan Legal Group will demystify probate. We will walk you through every step, explain the costs and timelines, and show you why professional guidance is not just a benefit, but a necessity.

Defining Probate: The Court’s Role in Estate Settlement

At its core, probate is the legal mechanism for winding up a person’s affairs after death. It is conducted in the Surrogate’s Court of the New York county where the deceased person (the “decedent”) resided. The court acts as a neutral overseer to ensure the entire process is handled fairly and according to the law. Its primary objective is to validate the decedent’s Last Will and Testament and grant the named Executor the legal authority to act.

The Key Objectives of the New York Surrogate’s Court

The probate process is not arbitrary; it serves several vital functions to protect everyone involved, from heirs to creditors.

- Authenticating the Will: The court’s first task is to determine if the will presented is the decedent’s true, final testament and if it meets all the strict legal requirements of New York law.

- Appointing the Fiduciary: The will nominates an Executor, but this person has no power until the court formally appoints them by issuing “Letters Testamentary.” If there is no will, the court appoints an “Administrator” and issues “Letters of Administration.” This is a critical step in any probate proceeding.

- Protecting Creditors: Probate provides an official forum for creditors (e.g., credit card companies, mortgage lenders, hospitals) to file claims for any outstanding debts owed by the decedent.

- Ensuring Proper Distribution: The court supervises the entire process to make sure that debts and taxes are paid correctly before any property is distributed to the beneficiaries named in the will.

- Resolving Disputes: If an heir contests the will’s validity or if beneficiaries disagree on the management of the estate, the court provides the legal framework to resolve these conflicts.

Essentially, probate provides a structured, supervised process that brings legal closure to a person’s financial life.

Testate vs. Intestate: The Two Paths Through Surrogate’s Court

The probate journey takes one of two primary paths, depending entirely on whether the decedent left a valid will.

Testate Administration: When There Is a Will

When a person dies with a valid will, they die “testate.” The will serves as the decedent’s instruction manual for the court. It names the beneficiaries who will inherit the property, nominates an Executor to manage the process, and may appoint a guardian for minor children. The probate process in this case revolves around executing the specific wishes laid out in that will. A comprehensive wills and trusts plan is the foundation of a testate estate.

Intestate Administration: When There Is No Will

When a person dies without a will, they die “intestate.” This does not mean the state takes the property. It means the court must supervise the estate settlement through a process called “administration.” Instead of following a will, the court-appointed Administrator distributes the assets according to a rigid formula set by New York’s intestacy laws (EPTL § 4-1.1). This formula dictates which relatives inherit and in what proportion, which may not align with the decedent’s actual wishes. This underscores the importance of proper estate planning.

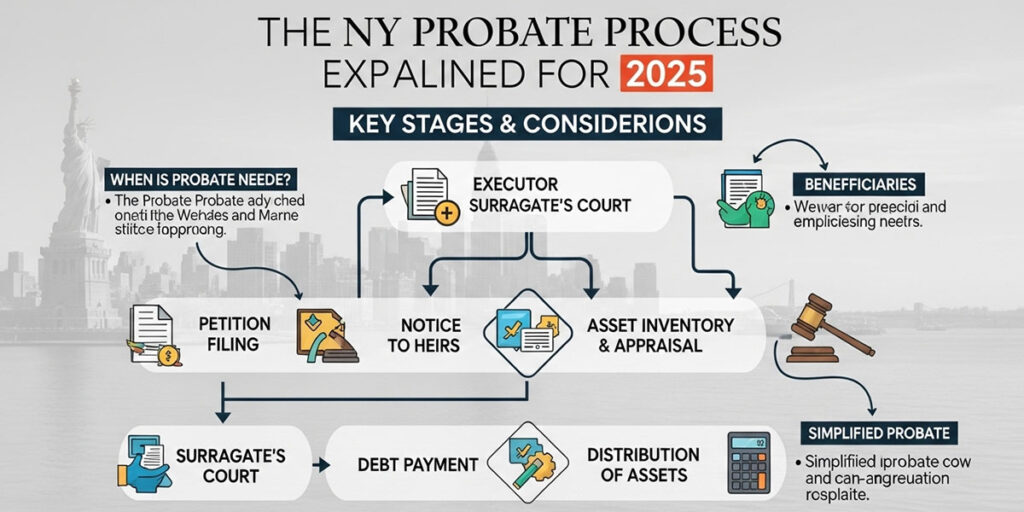

The Step-by-Step New York Probate Process in 2025

Navigating probate is a marathon, not a sprint. It involves a series of sequential steps, each with its own legal requirements and potential hurdles. Here is a detailed breakdown of the journey from start to finish.

Step 1: Filing the Petition for Probate

The process begins when the nominated Executor files a Petition for Probate and the original will with the Surrogate’s Court. This package also includes a certified copy of the death certificate and affidavits from the witnesses who signed the will. The petition asks the court to formally admit the will to probate and to officially appoint the Executor.

Step 2: Notifying All Interested Parties

Once the petition is filed, legal notice must be given to all of the decedent’s “distributees.” These are the legal heirs who would have inherited if the decedent had died without a will. This notice gives them the opportunity to appear in court and object to the will if they have grounds to do so (e.g., they believe the decedent was under undue influence). Failure to properly notify all parties can halt the entire process. This step is a common pitfall and a key reason to have an experienced attorney like Russel Morgan, Esq., on your side.

Step 3: Issuance of Letters Testamentary

If there are no objections, or if any objections are resolved, the Surrogate’s Court judge will sign a decree granting probate. The court then issues Letters Testamentary to the Executor. This is the single most important document in the process. It is the official certificate of authority that allows the Executor to act on behalf of the estate—to collect assets, open an estate bank account, and deal with financial institutions.

Step 4: Marshalling and Inventorying Assets

Armed with Letters Testamentary, the Executor’s real work begins. They must conduct a diligent search to identify, locate, and take control of all of the decedent’s probate assets. This process is called “marshalling the assets.” It includes creating a detailed inventory of everything from real estate and bank accounts to personal property. For assets with unclear value, such as real estate or business interests, the Executor must obtain formal appraisals to determine their fair market value as of the date of death.

Step 5: Paying Debts, Expenses, and Taxes

Before any beneficiary receives a dollar, the Executor must pay all legitimate debts and administrative expenses of the estate. This includes funeral costs, legal fees, and any outstanding bills. The Executor must also file the decedent’s final income tax returns and potentially an estate income tax return. Furthermore, if the estate is large enough, they must file and pay any applicable New York State or federal estate taxes. This financial management is a core fiduciary duty.

Step 6: Final Accounting and Distribution

Once all assets are collected and all debts are paid, the Executor prepares a final accounting. This detailed report shows all the money that came into the estate and all the money that went out. The accounting is presented to the beneficiaries for their approval. If all beneficiaries agree, they sign “Receipt and Release” forms, and the Executor can distribute the remaining assets. If a beneficiary objects, the Executor may need to file a formal judicial accounting with the court for approval.

Step 7: Closing the Estate

After all distributions are made and all receipts are collected, the estate can be formally closed. The Executor’s job is now complete. This is the final step in a long journey that often requires legal support from beginning to end. If you need assistance, please contact us.

What Assets Go Through Probate? (And What Assets Don’t)

A crucial part of understanding probate is knowing which assets are subject to the process. Only “probate assets”—those owned solely in the decedent’s name without a named beneficiary—are controlled by the will and the Surrogate’s Court.

Common Probate Assets

- Real estate owned individually or as a “tenant in common.”

- Bank accounts or brokerage accounts in the decedent’s sole name.

- Vehicles, jewelry, art, and other tangible personal property.

- An interest in a business (like a partnership or LLC) that is not governed by a succession plan.

- A life insurance policy or retirement account where the estate itself is named as the beneficiary.

Common Non-Probate Assets

Many valuable assets pass to their new owners automatically, by operation of law, completely bypassing probate.

- Assets Held in a Trust: Property titled in the name of a revocable or irrevocable trust is controlled by the trust document, not the will. This is a primary probate avoidance tool.

- Assets with Beneficiary Designations: Life insurance proceeds and retirement funds (401(k)s, IRAs) go directly to the named beneficiaries. A power of attorney does not control these assets after death.

- Payable-on-Death (POD) or Transfer-on-Death (TOD) Accounts: Bank and brokerage accounts with these designations are transferred directly to the beneficiary.

- Jointly Owned Property with Rights of Survivorship: Real estate owned by a married couple as “tenants by the entirety” or a bank account owned as “joint tenants with rights of survivorship” automatically passes to the surviving owner.

A major part of estate planning is strategically titling assets to minimize the size of the probate estate.

The Timeline: How Long Does Probate Take in New York?

This is the most common question families ask, and the honest answer is: it depends. There is no fixed timeline, and the duration of probate can vary dramatically based on the complexity of the estate and the dynamics of the family.

Simple Estates (6-12 Months)

For a straightforward estate with a clear will, cooperative beneficiaries, and easily identifiable assets, the process might take between 6 and 12 months. This allows enough time for the court to issue Letters, for creditors to be notified, and for assets to be collected and distributed.

Complex Estates (1-3+ Years)

Probate can stretch on for years if complications arise. Common causes for delay include:

- Will Contests: If an heir challenges the validity of the will, the process turns into litigation, which can add years and significant legal fees.

- Difficult-to-Value Assets:

- Tax Issues: If the estate is subject to estate tax, the process cannot be closed until a “closing letter” is received from the IRS and New York State, which can take a year or more.

- Uncooperative Beneficiaries: If beneficiaries are fighting or refuse to sign releases, a formal, time-consuming judicial accounting may be required.

- Issues with Creditors: Disputing a creditor’s claim can also lead to litigation and delays.

Managing expectations about the timeline is a key role of a probate attorney.

The Costs of Probate: What to Expect in 2025

Probate is not free. There are several layers of costs and fees, all of which are paid from the estate’s assets before the beneficiaries receive their inheritance.

Court Filing Fees

The New York Surrogate’s Court charges filing fees based on the value of the probate estate. These fees are set by statute and can range from $45 for very small estates to $1,250 for estates valued at $500,000 or more. For more information, you can reference the official New York State Unified Court System website.

Executor’s Commission

The Executor is entitled to a commission for their work, which is also set by New York law. The commission is calculated on a sliding scale based on the value of the assets passing through probate.

- 5% on the first $100,000

- 4% on the next $200,000

- 3% on the next $700,000

- 2.5% on the next $4,000,000

- 2% on any amount above $5,000,000

For a $1 million estate, the Executor’s commission would be $34,000. Family members serving as Executor can choose to waive this fee.

Attorney’s Fees

While not legally required, it is almost always necessary to hire an attorney to handle a probate proceeding. Legal fees are paid by the estate and must be “reasonable” as determined by the court. Attorneys may charge a flat fee, an hourly rate, or a percentage of the estate’s value. The cost will depend on the complexity of the case and the amount of work required. This investment protects the Executor from personal liability and ensures the process is handled correctly.

Other Administrative Costs

Additional costs can include appraiser fees, accountant fees, bond premiums (if the Executor is out-of-state), and other miscellaneous expenses related to managing and liquidating estate property.

Common Probate Challenges and How to Handle Them

Even with a solid will, the probate process can encounter turbulence. Being aware of these potential issues is the first step in addressing them.

Will Contests

A distributee who feels they were unfairly cut out of a will can file a “will contest,” challenging the will’s validity. Common grounds include lack of mental capacity, undue influence, fraud, or improper execution. A will contest turns the probate process into a lawsuit and can be emotionally and financially draining for the family. Strong evidence and expert legal representation are needed to defend the will.

Difficult Beneficiaries

Managing the expectations and emotions of grieving family members can be one of the Executor’s toughest jobs. Beneficiaries may be impatient, question the Executor’s decisions, or have conflicting views on how assets should be managed. Clear, regular communication and absolute transparency are the best tools to manage these dynamics. In some cases, family law experience can be beneficial.

Insolvent Estates

An estate is “insolvent” if its debts exceed its assets. In this case, the Executor must pay the debts according to a priority list set by New York law. Funeral expenses and administration costs get paid first, while general creditors like credit card companies are last in line and may only receive pennies on the dollar. Managing an insolvent estate is highly complex and carries significant personal liability risk for the Executor.

Why You Need an Experienced New York Probate Attorney

Given the procedural complexities, financial risks, and potential for conflict, navigating the New York Surrogate’s Court without an experienced probate lawyer is unwise. An attorney’s role is to guide the Executor through every step, protect them from liability, and make the process as efficient as possible.

At Morgan Legal Group, we handle the entire process for our clients. We prepare and file all court documents, communicate with beneficiaries and creditors, advise on tax matters, and provide strategic counsel to resolve any disputes that arise. We have helped countless families in Brooklyn and across New York City successfully settle their loved ones’ estates. Our expertise in related fields, such as elder law and guardianship, gives us a holistic perspective on these sensitive family matters.

Your Guide Through the Process

Probate in New York is a necessary, and often unavoidable, legal process. While it can be daunting, it is not insurmountable. Understanding the steps, timelines, and costs involved empowers you to face the process with clarity and confidence. The key to a successful probate administration is preparation and professional guidance.

If you have been named the Executor of a loved one’s estate or are facing the prospect of administering an estate without a will, you do not have to do it alone. The legal team at Morgan Legal Group is here to lift the burden from your shoulders. We combine decades of legal experience with compassionate, personalized service to guide you through this challenging time. Let us handle the complexities of the court so you can focus on your family.

Take the first step toward a smooth and efficient estate settlement. Schedule a consultation with our expert New York probate attorneys today. Learn more about our firm and our commitment to our clients by visiting us on Google.