The Truth About Probate in New York State

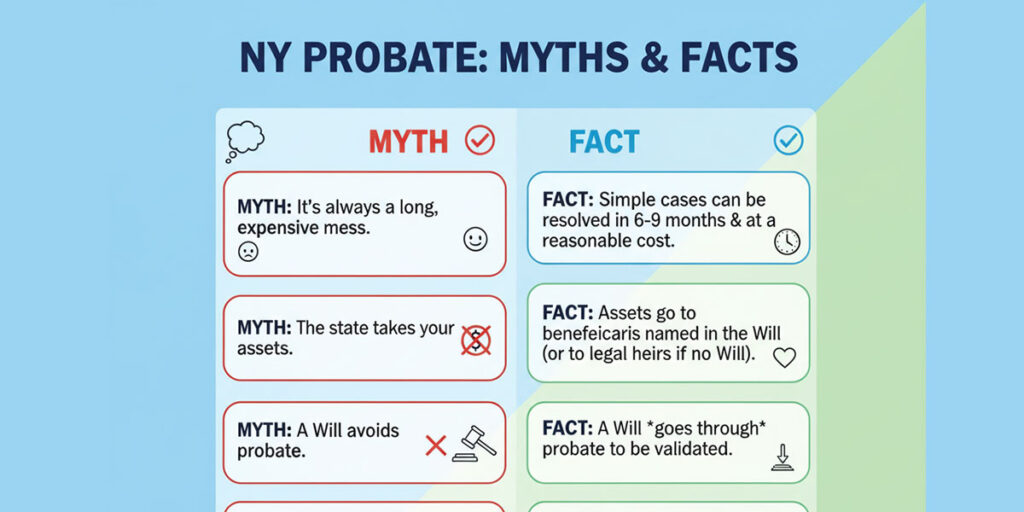

In my three decades as a New York probate attorney, I have found that no other legal process inspires as much fear and misunderstanding as probate. The very word conjures images of endless courtroom battles, predatory lawyers, and family fortunes vanishing into a bureaucratic abyss. These dramatic notions, often fueled by television and whispered warnings, paint a picture of a monstrous system designed to complicate grief and drain estates. But the reality is far more mundane and manageable.

Probate, at its core, is simply a court-supervised process for settling a person’s final affairs. It is the orderly transfer of assets from one generation to the next, governed by a clear set of rules designed to protect all parties involved. It is a necessary procedure to ensure that a deceased person’s will is valid, their debts are paid, and their property is distributed to the correct beneficiaries. While it can have complexities, it is not the monster it is often made out to be.

At Morgan Legal Group, a significant part of our work is guiding families through the probate process with clarity and efficiency. We believe that replacing fear with facts is the first step toward easing the burden on grieving families. In this guide, we will systematically debunk the most common and damaging misconceptions about probate in New York, providing you with the accurate information you need to understand the path ahead. For expert guidance tailored to your situation, please contact our team.

Misconception #1: “A Will Avoids Probate.”

This is perhaps the most widespread misunderstanding in all of estate planning. Many people spend their lives believing that by creating a Last Will and Testament, they have created a document that allows their family to bypass the court system entirely. They see the will as a magic key that instantly transfers property to their loved ones upon their death. The truth is the exact opposite.

The Reality: A Will is the Instruction Manual FOR Probate

A will does not avoid probate; it directs it. The entire purpose of the probate process is for the New York Surrogate’s Court to formally validate your will, confirm its authenticity, and grant your chosen executor the legal authority to act on its instructions. Think of your will as the script for a play, and probate as the stage where that play is officially performed under the court’s supervision. Without the probate process, your will is just a piece of paper with no legal power.

How the Process Actually Works

When you die, your executor must submit the original will to the Surrogate’s Court in the county where you resided. This is done by filing a “Petition for Probate.” The court then reviews the will to ensure it meets all the requirements of New York law (in writing, signed, and properly witnessed). The court also ensures that all of your legal heirs (your “distributees”) are notified, giving them a chance to object. Once the court is satisfied that the will is valid, it issues “Letters Testamentary,” a legal document that officially appoints your executor and gives them the authority to manage your estate according to the will’s terms.

The True Way to Avoid Probate

The only way to avoid probate is to structure your assets so they are not part of your “probate estate.” This is a core strategy in modern estate planning. Assets that bypass probate include:

- Assets held in a Revocable or Irrevocable Trust.

- Property owned as “Joint Tenants with Rights of Survivorship.”

- Life insurance policies and retirement accounts with named beneficiaries.

- Bank accounts with “Payable on Death” (POD) or “In Trust For” (ITF) designations.

A carefully drafted will is a vital part of any estate plan, but understanding its true function is the first step to dispelling myths. Our attorneys specializing in wills and trusts can help you understand which tools are best suited to your goals.

Misconception #2: “Probate Always Takes Years and Costs a Fortune.”

The second great fear of probate is that it is an endless and expensive black hole. People envision their family’s inheritance being whittled away by exorbitant fees over a period of many years. While it is true that some estates—particularly those with complex assets, heated disputes among heirs, or significant tax issues—can be lengthy and costly, this is not the norm.

The Reality: Most NY Estates are Probated Efficiently and for a Reasonable Cost

For a straightforward estate in New York, the probate process can often be completed in about 7 to 12 months. The cost is not arbitrary; it is based on a predictable set of factors, many of which are regulated by law. The idea of the “million-dollar probate” for an average estate is largely a myth.

Factors Affecting the Timeline

- Court Caseload: The Surrogate’s Court in busy jurisdictions like New York City can have backlogs that cause initial delays.

- Simplicity of Assets: An estate with a house, a bank account, and a few stocks is far easier to manage than one with a family business and multiple out-of-state properties.

- Finding Heirs: If a legal heir is difficult to locate, the process can be delayed until they are properly notified.

- Will Contests: If a disgruntled heir challenges the validity of the will, the process can grind to a halt and turn into lengthy litigation.

Understanding the Costs of Probate

The costs associated with probate are not a single, massive fee. They are a collection of distinct expenses:

- Court Filing Fees: These are set by statute and are based on the value of the probate estate.

- Executor’s Commission: In New York, executors are entitled to a commission based on a percentage of the estate’s value, also set by state law.

- Attorney’s Fees: Legal fees for the estate’s attorney must be “reasonable” and are subject to review by the Surrogate’s Court. They can be a flat fee, hourly, or a percentage, but they are not a blank check.

- Other Costs: These can include fees for property appraisals, accountant fees for a final tax return, and other administrative expenses.

While probate is not free, its costs are generally manageable and predictable. An experienced probate attorney, like Russel Morgan, can provide a realistic estimate of the timeline and costs for your specific situation.

Misconception #3: “If I Die Without a Will, the State of New York Gets My Property.”

This is a common scare tactic used to motivate people to create a will. The fear is that if you fail to plan, the government will swoop in and seize your life’s savings. This is almost certainly not true.

The Reality: The State Inherits Only as a Last Resort

The state of New York will only inherit your property through a process called “escheat” if you die with absolutely no living relatives who can be located. This includes not just your immediate family but also grandparents, aunts, uncles, cousins, and even the children of first cousins. The law is designed to find a family member to inherit your property, no matter how distant.

New York’s Intestacy Laws: The State’s “Default Will”

When you die without a will (dying “intestate”), New York’s Estates, Powers and Trusts Law (EPTL) § 4-1.1 provides a rigid hierarchy for who inherits your property. This is often called the “law of intestacy.”

- If you have a spouse and no children, your spouse inherits 100%.

- If you have a spouse and children, your spouse gets the first $50,000 and half of the rest. Your children get the other half.

- If you have children and no spouse, your children inherit 100%.

- If you have no spouse or children, your parents inherit, then your siblings, and so on.

The real danger of not having a will isn’t that the state will take your money. The danger is that the people you would have wanted to inherit your property will be legally shut out. An unmarried partner, a beloved stepchild, a close friend, or a favorite charity will receive nothing under intestacy law. The law will instead give your property to a distant cousin you haven’t seen in 30 years, simply because they are next in the legal line. This is a crucial topic we cover in our family law and estate planning consultations.

Misconception #4: “The Probate Judge Can Change My Will.”

Many people have a fundamental misunderstanding of the role of the Surrogate’s Court judge. They worry that a judge who disagrees with their choices—for example, leaving more to one child than another—can simply ignore the will and distribute the property as they see fit.

The Reality: The Court’s Job is to Enforce Your Will, Not Rewrite It

A Surrogate’s Court judge’s primary function in a probate proceeding is to act as a referee, not a king. Their job is to ensure that your will is valid and that your executor follows its instructions precisely as written. They do not have the legal authority to substitute their own judgment for yours or to decide what is “fair.” Your will is your final word, and the court’s duty is to honor it.

The court’s role is procedural. It authenticates the will, officially appoints the executor, and provides a forum for resolving any legal disputes that arise, such as a will contest or a dispute over a creditor’s claim. But the judge cannot say, “I think you should have given your daughter the house instead of your son.” As long as your will is legally valid, your wishes are paramount. This is a stark contrast to a guardianship proceeding, where a judge does make personal decisions for an incapacitated individual.

Misconception #5: “The Executor Can Do Whatever They Want.”

The person named as executor in a will wields significant power, which can be a source of anxiety for beneficiaries. There’s a common fear that an executor can act like a dictator, ignoring the will, selling assets for personal gain, or favoring one beneficiary over another.

The Reality: An Executor is a Fiduciary with Strict Legal Duties

An executor is a “fiduciary,” which is the highest standard of trust and responsibility under the law. They have a legal obligation to act solely in the best interests of the estate and its beneficiaries. They are not free agents; they are accountable to the beneficiaries and supervised by the Surrogate’s Court.

Key Duties and Limitations of an Executor:

- Duty of Loyalty: They must not engage in “self-dealing,” such as selling estate property to themselves at a discount or hiring their own company to perform services for the estate.

- Duty to Follow the Will: They must distribute the property exactly as specified in the will. They cannot change the terms. – Duty to Marshal and Protect Assets: They must locate all estate assets and protect them from waste or loss.

- Duty to Account: They must keep meticulous records of all money coming in and out of the estate. Beneficiaries have the right to demand a formal accounting to see how the estate has been managed.

If an executor breaches their duties, beneficiaries can petition the court to have them removed and held personally liable for any damages they caused. This potential for personal liability is a powerful deterrent against misconduct, which is why cases of true elder abuse or fraud by an executor are taken so seriously by the courts.

Misconception #6: “I Don’t Need a Lawyer for Probate in New York.”

In an era of DIY legal websites, many people, especially those appointed as executor, believe they can handle the probate process on their own to save money. They assume it’s a matter of filling out a few simple forms and filing them with the court.

The Reality: The NY Surrogate’s Court Process is Governed by Complex Rules

While it is technically possible for an individual to file for probate “pro se” (representing themselves), it is fraught with peril. The Surrogate’s Court Procedure Act is a complex body of law with strict and often confusing procedural requirements. A single mistake—failing to notify the correct parties, filling out a form incorrectly, or missing a deadline—can cause the entire process to be rejected or delayed for months, costing the estate more in the long run.

Why Legal Counsel is Essential

An experienced probate attorney does more than just fill out paperwork. They:

- Navigate the Court System: We know the specific procedures and personnel in the local Surrogate’s Courts, like those in Long Island or the five boroughs.

- Ensure Proper Notification: We identify and properly serve all legal distributees, even obscure or long-lost relatives, preventing future challenges.

- Manage Creditor Claims: We handle claims from creditors, negotiating and settling debts on behalf of the estate.

- Provide Legal Protection: We guide the executor in fulfilling their fiduciary duties, protecting them from personal liability.

- Handle Complexities: We manage issues like will contests, tax filings, and the liquidation of complex assets.

Trying to navigate probate alone is like trying to perform your own electrical work; you might succeed, but a single mistake can have serious consequences. The cost of hiring a lawyer is a legitimate administrative expense of the estate and provides invaluable protection and peace of mind.

Conclusion: Replacing Probate Myths with Legal Reality

The probate process in New York is surrounded by a fog of misinformation that can cause unnecessary anxiety for families already dealing with the loss of a loved one. By understanding the reality behind these common myths, you can approach the process with confidence and a clear perspective. A will directs probate; it doesn’t avoid it. The process is typically manageable in both time and cost. The court is there to enforce your wishes, not to rewrite them. And the executor is an accountable fiduciary, not an all-powerful ruler.

Most importantly, you do not have to navigate this process alone. The complexities of the Surrogate’s Court are why experienced legal counsel is not a luxury, but a necessity for the proper and efficient administration of an estate. Let us help you cut through the fog. If you are facing the probate process or want to structure an estate plan that makes it as smooth as possible for your family, we are here to help. Schedule a consultation with Morgan Legal Group today and let our three decades of experience bring you clarity and peace of mind.

For more official information on court procedures, you can visit the New York State Unified Court System’s guide to probate.