Understanding Estate Planning with Trusts in New York

In the dynamic landscape of estate planning for 2026 and beyond, a trust emerges as a powerful and versatile tool. Beyond a simple will, a

Home » Estate Planning » Wills and Trusts » Trusts » Page 2

In the dynamic landscape of estate planning for 2026 and beyond, a trust emerges as a powerful and versatile tool. Beyond a simple will, a

Understanding New York Trusts: A Cornerstone Guide to the Seven Essential Elements Effective estate planning in New York demands a thorough understanding of the legal

The Definitive 2026 Guide to Medicaid Asset Protection Trusts in New York Navigating the complexities of long-term care planning and asset preservation in New York

What is the Role of a Trustee When You Die? A NY Expert Explains Being named a “Successor Trustee” in a loved one’s estate plan

Securing Their Future: The Definitive Guide to Special Needs Estate Planning As a parent, your deepest instinct is to protect your child. For parents of

Special Needs Trusts: Why a Specialist, Not a Generalist, Is Essential For a parent or guardian of a child or loved one with special needs,

Wills and Trusts on Long Island: A Comprehensive Guide to Protecting Your Legacy Life on Long Island, from the close-knit communities of Nassau County to

A Queens Resident’s Guide to Wills and Trusts From the historic homes of Forest Hills Gardens to the bustling multicultural streets of Flushing and the

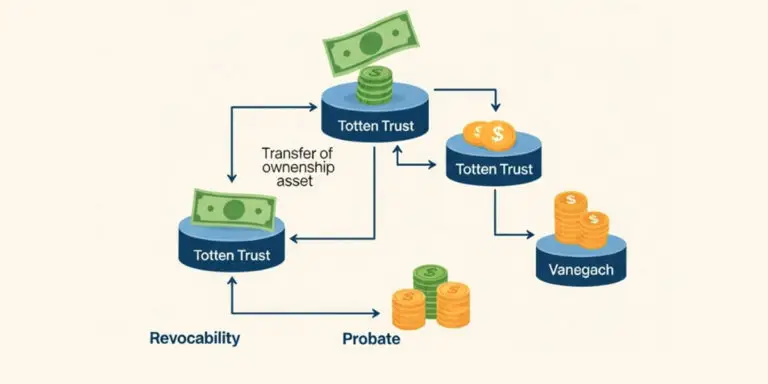

What Is a Totten Trust? An Expert Guide for New Yorkers In the world of estate planning, individuals often seek straightforward methods to transfer assets

Private Foundations in New York: Creating a Legacy of Giving and Maximizing Your Philanthropic Impact For individuals and families with a deep commitment to philanthropy,