The 8 Essential Documents for Your New York Estate Plan (2025 Guide)

NY’s 8 Essential Estate Planning Documents As a New York estate planning attorney with many years of experience, I’ve learned one thing from handling over

Home » Estate Planning » Wills and Trusts » Page 4

NY’s 8 Essential Estate Planning Documents As a New York estate planning attorney with many years of experience, I’ve learned one thing from handling over

The 3 Pillars of a New York Estate Plan For over 30 years, I have sat with thousands of New Yorkers to discuss their legacies.

The Great Misconception: Why Your Will is the Key TO Probate Court, Not a Way Around It It is, without a doubt, the single most

Understanding Key Estate Planning Tools At the very heart of responsible estate planning lie two of the most powerful and important legal documents you will

Why You Need an Attorney for Wills and Trusts in New York In our modern world, the do-it-yourself (DIY) ethos is everywhere. We are empowered

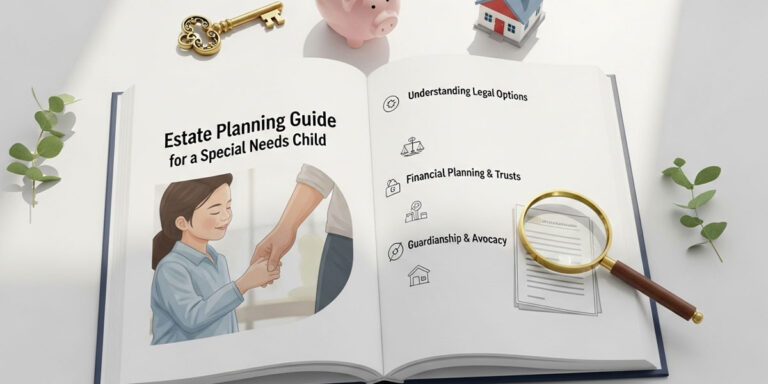

Securing Their Future: The Definitive Guide to Special Needs Estate Planning As a parent, your deepest instinct is to protect your child. For parents of

Choosing Between a Will and a Trust in New York Planning for the future is one of the most profound acts of responsibility and care

Special Needs Trusts: Why a Specialist, Not a Generalist, Is Essential For a parent or guardian of a child or loved one with special needs,

Wills and Trusts on Long Island: A Comprehensive Guide to Protecting Your Legacy Life on Long Island, from the close-knit communities of Nassau County to

A Queens Resident’s Guide to Wills and Trusts From the historic homes of Forest Hills Gardens to the bustling multicultural streets of Flushing and the